Recently, a client contacted me regarding collection calls for debts that she did not recall incurring. According to her, she never used credit cards and she purchased her used car years ago in cash. But, the debt collectors were sure the charges were made by someone with her name and social security number. After checking her credit report she found that she had been a victim of identity theft. Even though she thought she had taken the proper precautions to protect her personal information, identity thieves still managed to get a hold of her information and use it to open credit cards fraudulently and because she never checked her credit information she did not know this was happening for several months (until the debt collectors started calling). Thankfully, I was able to resolve her issue with the debt collectors by proving that those debts were not hers.

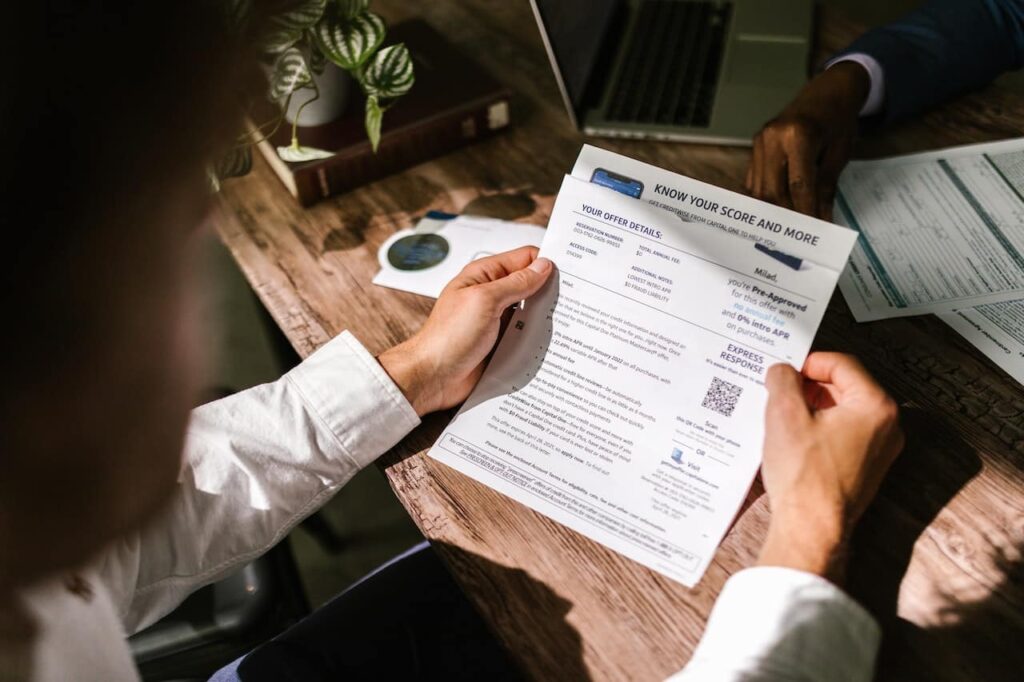

Unfortunately, this is a situation that occurs much to often to people and can be very time-consuming and frustrating. In order to lessen your vulnerability to identity thieves I suggest, in addition to shredding all of your mail before throwing it away, I also recommend “Fraud Alerts”. A free Fraud Alert instructs creditors to contact you by phone to verify that you have, in fact, authorized a credit check, adding an extra layer of protection to you. However, while fraud alerts can block some credit related identity thefts, they are not foolproof.

Another suggestion is to regularly review your credit report to determine who accesses your files and when. If you notice that a lender pulled your credit without your permission, you may contact the lender to determine the reason for the unauthorized inquiry. While a fraud alert permits creditors to get your report as long as they take steps to verify your identity, a credit freeze stops all access to your credit report.

The credit bureaus’ fraud alert system is a good no-cost option for those with concerns about identity theft, a credit freeze is a costlier method, but can be more thorough. Combined with a regular credit report monitoring and taking care to protect your personal information, a credit freeze can be very effective at protecting your credit.

If you are getting calls from debt collectors for debts that are not yours please give my office, The Law Offices of Todd M. Friedman a call today at (877) 449-8898