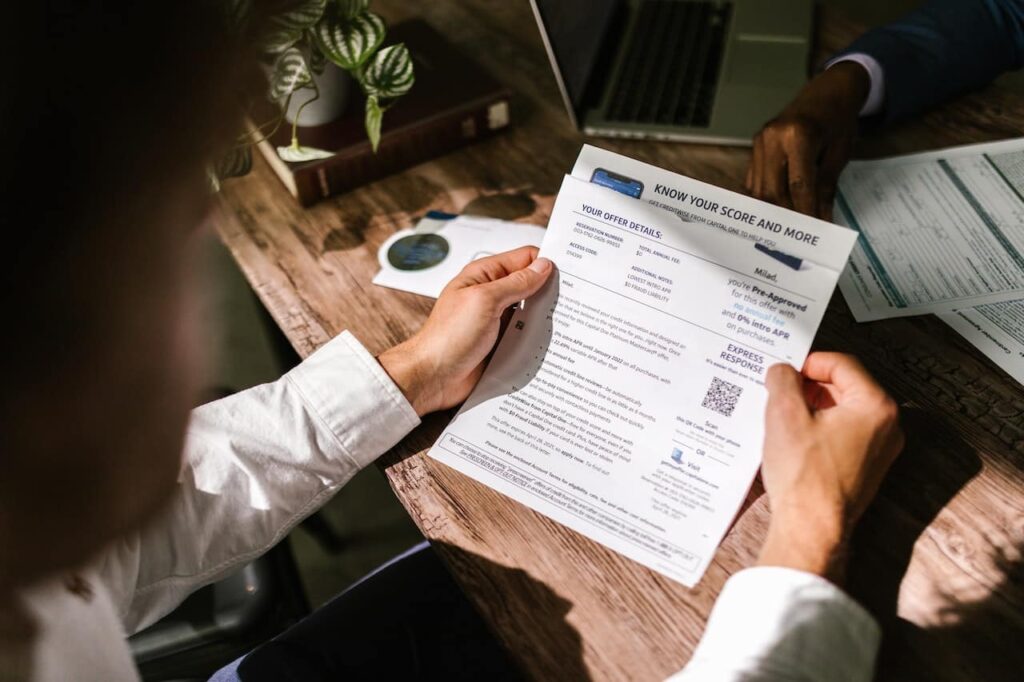

It’s one of the easiest ways to accidentally spend money – start a free trial of a service, then forget to cancel until you find a strange charge on your credit card when the trial period ends. Then when you try to cancel you discover the subscription can only be cancelled over the phone, even though everything else is online.

Hidden charges and complicated cancellation processes have frustrated consumers for years, but in 2018 the California legislature fought back. Consumers now have even greater protection from confusing business practices by online subscriptions.

No more sneaky automatic renewals

Existing law made it unlawful for businesses offering services with an automatic renewal to fail to make the renewal terms clear and conspicuous to consumers. The new law, passed in July, expands this rule to services that include an initial free gift or a free trial. Under California Senate Bill 313, price increases and other changes that occur at the end of a free trial must be clearly presented prior to a customer signing up. In a recent case, the parent company of several online dating sites including Christian Mingle was sued for automatically renewing subscriptions without the express consent of their customers.

Start online and cancel online

This new consumer protection law also addresses another annoyance: online subscriptions that can only be cancelled by phone. In the past, customers were often forced to call and speak to a sales representative to end a subscription, even if they signed up online.

In many cases, these phone calls would include a long survey or extensive conversations where company employees would try to convince the customer to keep their subscription. In some cases, the person receiving the cancellation call would simply hang up. Now, subscriptions that begin online must provide the option of cancelling online.

According to the Los Angeles Times, the senator who wrote the bill stated that consumers need to know what they are signing up for when it comes to online services.

As more and more services operate entirely online, consumer protection laws will have to keep up. Based on these developing regulations, the California legislature seems to be serious about ensuring online businesses are transparent with their customers.