According to Richard Cordray, the Consumer Financial Protection Bureau’s director, “Debt collectors and credit reporting agencies have gone unsupervised by the federal government for too long.”

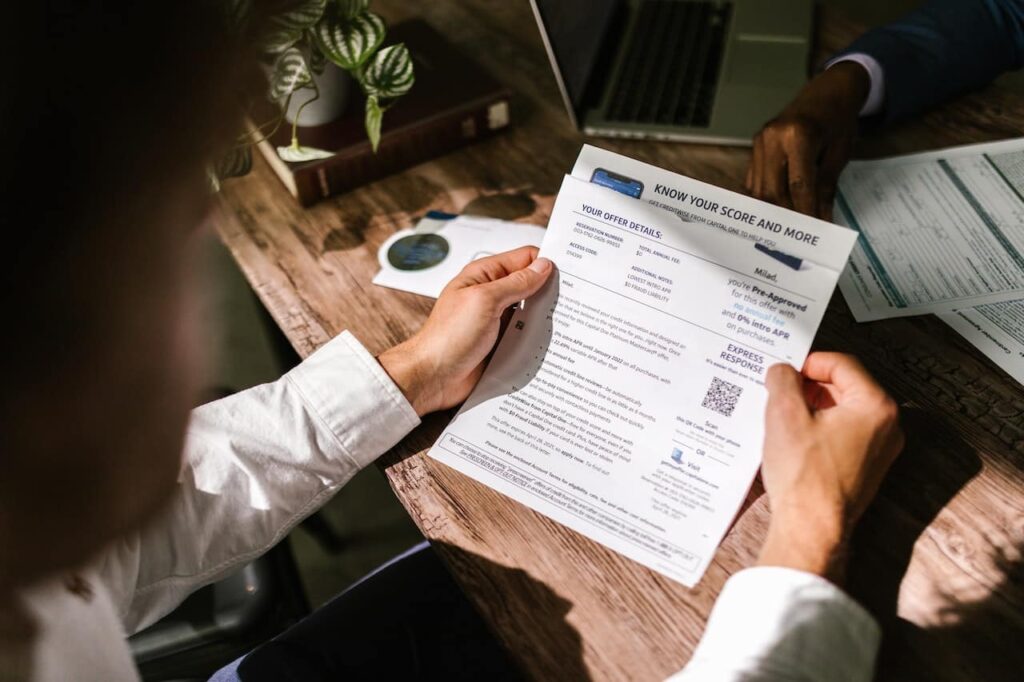

Debt collection has been among the top consumer complaints to the Federal Trade Commission in recent years. , Experian Information Solutions Inc., Equifax Inc. and TransUnion, have records on 200 million Americans and hold the key to getting a loan.

Their practices have been mysterious to consumer advocates for years, and the this federal oversight should help reduce the number of mistakes on credit reports, said Ed Mierzwinski, consumer program director for the U.S. Public Interest Research Group.

If you are being harassed by debt collectors that are violating the law, please give my office, The Law Office of Todd M. Friedman a call today at (877) 449-8898 for a free consultation.